In many nations, it is not viable for financial institutions to provide at fixed rates for very long terms; in these instances, the only practical type of mortgage for banks to https://jeffreypbbt355.shutterfly.com/167 supply may be adjustable rate mortgages. As an example, the mortgage industry of the United Kingdom has actually typically been controlled by constructing cultures. The regards to today's adjustable-rate loans birth little resemblance to that Wild West providing atmosphere.

- Unlike fixed mortgages where you pay the same rate of interest over the life of the financing, with an ARM, the rate of interest will certainly transform after an amount of time, and in some cases, it might climb significantly.

- Debt.org wishes to assist those in the red comprehend their financial resources as well as furnish themselves with the tools to manage financial obligation.

- That implies your monthly mortgage payment can rise or down twice a year.

- The degree of income you have will aid the lender determine exactly how huge of a mortgage settlement you can receive.

Past the lending term, you will come across adhering finances and also nonconforming lendings as you discover your ARM options. Apply online for professional suggestions with genuine rate of interest and payments. After that the rate of interest can change every 6 months for the remaining 25 years. VA ARM loans are utilized by veterans and active-duty servicemembers to get homes with 0% down and no exclusive mortgage insurance coverage. To obtain a VA lending, you require a Certification of Qualification to verify you get approved for the advantage, and also you'll likewise pay a VA financing charge throughout closing. Some ARMs bill prepayment penalties of numerous thousand dollars if the consumer refinances the funding or pays it off early, specifically within the first three or five years of the lending.

Our info is readily available free of charge, nonetheless the solutions that show up on this site are offered by firms that might pay us an advertising and marketing cost when you click or register. These business might influence exactly how and where the services show up on the page, yet do not affect our timeshare refund content choices, recommendations, or advice. ARMs got a shiner in the realty market crash of 2007, but the swelling has decreased sufficient that they stand for 14% of the buck volume on home loan applications in 2018. These complexities can pose threats for borrowers that do not fully recognize what they're getting involved in. This might influence which products we assess and also discuss, but it in no other way influences our referrals or advice, which are grounded in hundreds of hrs of research. Our companions can not pay us to assure beneficial evaluations of their service or products.

The rate adjusts according to a preset schedule, often annually, to mirror existing market rates. So the price can go up or down, depending on what the market is doing. They're described as hybrids because they act like fixed-rate home loans throughout the initial duration.

This issues Sarah Bolling Mancini, a personnel lawyer with the nonprofit National Consumer Legislation Facility, specifically when it involves newbie buyers, that are facing high barriers to own a home. As well as there are additionally restricts on just how much an ARM can change greater, lessening the impact on borrowers. Considering that the start of the pandemic via February, reaching a high of almost $400,000, according to information from Realtor.com. The info had on The Mortgage Records website is for educational purposes only and is not a promotion for items supplied by Full Beaker. The views and point of views revealed herein are those of the author as well as do not mirror the policy or setting of Full Beaker, its police officers, moms and dad, or associates.

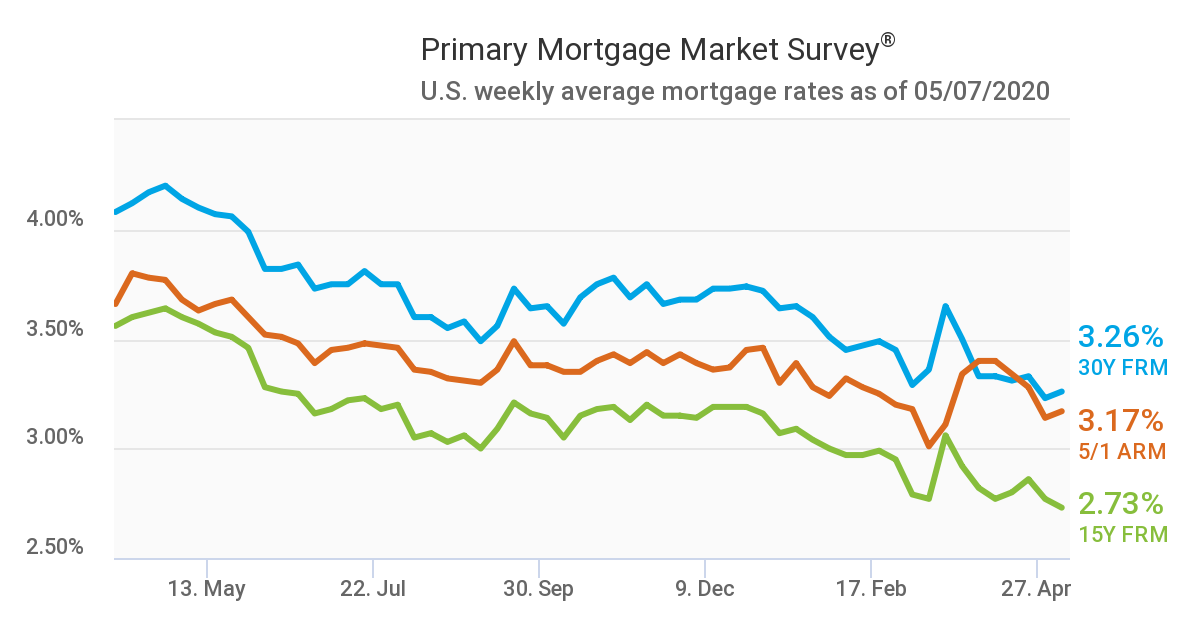

In our theoretical instance, allow's state you can obtain a 30-year fixed-rate mortgage at 4%. We'll contrast that against a 5/1 ARM with 2/2/5 caps and a preliminary rate of interest of 3.5%. Most individuals like assurance and, especially with today's low rates of interest, choose fixed-rate mortgages. S supply a set rate of interest for the first 5 years of the funding term. The second number describes just how commonly the price readjusts after the initial 5 years.

Home Mortgage Menu

Here are some terms you must be familiar with if you plan to opt for an ARM. ARMs can make sense for customers that know they will certainly be transferring in the future or they know they will certainly be repaying the finance in a couple of years. Numerous or all of the products included here are from our companions who compensate us. This might affect which items we write about and where and also how the product appears on a page. Although the authors attempt to give reputable, helpful information, they do not ensure that the info or various other material in this document is exact, current or suitable for any kind of certain purpose.

Youre Our Very First Priority Each Time

The actual rates as well as price analysis of adjustable rate home loan in the money sector is done through numerous computer system simulation approaches like Monte Carlo technique or Sobol sequences. Having these at hand, offering analysts identify whether offering a certain mortgage would be profitable, as well as if it would certainly represent tolerable danger to the financial institution. The fact that an adjustable price home loan has a lower beginning rates of interest does not suggest what the future cost Find more info of loaning will be

Housing prices are climbing, but the monetary guidelines for putting together a down payment still apply. Our team believe everyone needs to have the ability to make monetary choices with confidence. And because many people do not require to secure a rate for thirty years-- they often relocate well before the home mortgage is paid off-- a 7-1 or 5-1 ARM can frequently make a great deal of feeling. Let's say you like what you thought would be your starter residence and have actually determined you want to remain there forever. If you have an exchangeable ARM, it has an arrangement that grants you this choice. Nevertheless, if you are thinking about an ARM now, be aware that it will certainly cost you a lot more in advance, which may defeat the whole point of choosing the ARM to begin with.